body {

font-family: Arial, sans-serif;

margin: 20px;

}

h1 {

color: #333333;

font-size: 28px;

font-weight: bold;

margin-bottom: 10px;

}

h2 {

color: #333333;

font-size: 24px;

font-weight: bold;

margin-bottom: 10px;

}

p {

color: #666666;

font-size: 16px;

line-height: 1.5;

}

a {

color: #007BFF;

}

ul {

list-style: disc;

margin-left: 20px;

}

li {

margin-bottom: 10px;

}

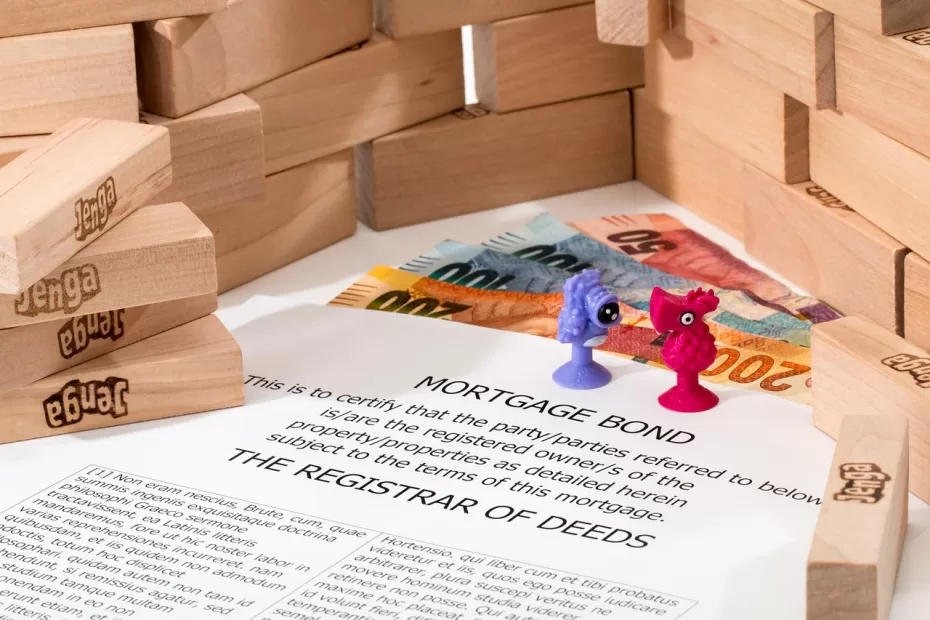

Revolutionizing Mortgages: Unlocking Financial Freedom in the Digital Age

The mortgage lending industry has been undergoing significant changes in recent years, driven by advancements in technology and shifting consumer expectations. The rise of digital platforms and automated processes has revolutionized the mortgage application and approval process, unlocking financial freedom for homebuyers and investors.

Overview of the Mortgage Lending Industry

The mortgage lending industry plays a crucial role in the real estate market by providing individuals and businesses with the funds needed to purchase properties. Lenders evaluate borrowers’ creditworthiness, income, and financial stability to determine their eligibility for a mortgage loan. Traditionally, this process involved extensive paperwork, manual verification, and lengthy approval times.

However, with the advent of digitalization, mortgage lenders have embraced technology to streamline and simplify the mortgage lending process. Online platforms, artificial intelligence, and data analytics are being leveraged to expedite loan approvals, reduce paperwork, and enhance the overall customer experience.

Impact of Mortgage Rates on the Real Estate Market

Mortgage rates, which represent the interest rate charged on a mortgage loan, have a significant impact on the real estate market. Fluctuations in mortgage rates can influence homebuyers’ purchasing power and affordability, as well as affect the overall demand for properties.

When mortgage rates are low, it becomes more affordable for individuals to borrow money and purchase homes. This increased affordability typically leads to higher demand for real estate, driving up property prices. Conversely, when mortgage rates are high, borrowing becomes more expensive, and demand for homes may decrease, resulting in a slowdown in the real estate market.

Interest rates are influenced by various factors, including the Federal Reserve’s monetary policy, inflation rates, and overall economic conditions. Mortgage rates tend to follow the trends of long-term government bond yields, such as the 10-year Treasury yield.

Recent Trends in Mortgage Rates

Over the past decade, mortgage rates have experienced notable fluctuations. Following the global financial crisis in 2008, mortgage rates plummeted as central banks implemented measures to stimulate economic growth and recovery. The historically low mortgage rates that followed contributed to a surge in homebuying activity and a rebound in the real estate market.

In recent years, mortgage rates have remained relatively low, hovering around historic lows due to the Federal Reserve’s accommodative monetary policy and low inflation rates. However, in response to economic recovery and rising inflation concerns, mortgage rates have started to gradually increase.

The COVID-19 pandemic also had a significant impact on mortgage rates. As uncertainty gripped the global economy, the Federal Reserve implemented emergency measures to stabilize financial markets. These measures included reducing interest rates to near-zero levels. Consequently, mortgage rates reached record lows in 2020, fueling a surge in refinancing activity and home purchases.

Developments and Changes for Potential Homebuyers and Investors

With the evolving landscape of the mortgage lending industry, potential homebuyers and investors need to stay informed about the recent developments and changes that may affect their mortgage options and real estate decisions.

1. Rising Mortgage Rates

As the global economy continues to recover from the impacts of the pandemic, mortgage rates are anticipated to increase gradually. This upward trend may reduce homebuyers’ purchasing power, making it more challenging to afford properties. Therefore, individuals planning to enter the real estate market should closely monitor mortgage rate trends.

2. Digital Mortgage Application Process

The digitalization of the mortgage lending process has made it more convenient and accessible for borrowers. Online platforms allow applicants to submit their information, upload documents, and track the progress of their application digitally. This streamlined process saves time and effort for homebuyers and investors.

3. Increased Automation and Data Analytics

Lenders are increasingly utilizing automation and data analytics to evaluate borrowers’ creditworthiness and streamline loan approvals. These technologies allow for faster and more accurate assessments, reducing the time required for underwriting and improving the overall efficiency of the mortgage lending process.

4. Enhanced Customer Experience

The integration of technology in the mortgage lending industry has significantly improved the customer experience. Borrowers can access personalized loan offers, compare rates from multiple lenders, and receive real-time updates on their application status. This increased transparency and convenience empower borrowers with more control over their mortgage journey.

5. Mortgage Refinancing Opportunities

The low mortgage rates observed in recent years have created opportunities for homeowners to refinance their existing mortgages. Refinancing allows borrowers to replace their current loan with a new one, often at a lower interest rate, resulting in potential savings on monthly mortgage payments. Homeowners should explore refinancing options to take advantage of favorable rates.

Future Implications for the Mortgage and Real Estate Sectors

The ongoing digital transformation and evolving mortgage rate environment are expected to shape the future of the mortgage and real estate sectors in several ways:

1. Continued Digitalization

The mortgage lending industry will likely continue to embrace digitalization, further streamlining the loan application and approval process. Online platforms will become more advanced, providing borrowers with personalized recommendations, automated document verification, and seamless communication with lenders.

2. Emphasis on Data Security

As more sensitive financial information is shared online during the mortgage application process, data security will become a top priority. Lenders will need to invest in robust cybersecurity measures to protect borrowers’ personal and financial data, ensuring trust and confidence in the digital mortgage ecosystem.

3. Integration of Artificial Intelligence

Artificial intelligence (AI) will play a significant role in mortgage lending, enabling lenders to make more accurate risk assessments and personalized loan offers. AI-powered chatbots and virtual assistants will also enhance customer service by providing instant support and answering borrowers’ questions throughout the mortgage journey.

4. Shift in Homebuying Patterns

The combination of rising mortgage rates and changing demographics may result in a shift in homebuying patterns. Younger generations, such as millennials and Gen Z, may opt for more affordable housing options, including smaller homes or urban rentals. Additionally, remote work trends may encourage individuals to relocate to suburban or rural areas, impacting demand in different regions.

5. Sustainability and Energy Efficiency

As environmental consciousness grows, there will be an increased emphasis on sustainable and energy-efficient homes. Lenders may offer incentives, such as lower interest rates or favorable loan terms, for properties that meet certain sustainability criteria. This trend aligns with the broader societal focus on reducing carbon footprints and promoting greener living.

In conclusion, the mortgage lending industry is experiencing a digital revolution that is reshaping the way individuals access financing for real estate purchases. Mortgage rates play a crucial role in the real estate market, and potential homebuyers and investors should stay informed about the changing landscape. The integration of technology, rising mortgage rates, and evolving consumer preferences will continue to shape the future of the mortgage and real estate sectors, offering new opportunities and challenges for all stakeholders involved.