What Is a Mortgage and How Does It Work?

A mortgage makes homeownership possible by spreading the cost over many years

A mortgage is a loan specifically designed for purchasing real estate. It’s a legal agreement where a lender provides funds to buy a home, and in return, you agree to repay the loan with interest over a set period, typically 15 to 30 years. The property itself serves as collateral, meaning the lender can take possession of it through foreclosure if you fail to make payments.

The Basic Structure of a Mortgage

When you make monthly mortgage payments, you’re paying toward two main components:

Principal

This is the original amount you borrowed to purchase the home. At first, only a small portion of your monthly payment reduces the principal balance.

Interest

This is the cost of borrowing money, calculated as a percentage of your remaining loan balance. Initially, most of your payment goes toward interest.

Over time, this balance shifts in what’s called amortization. As your loan matures, more of each payment goes toward the principal and less toward interest, until you eventually own the home outright.

Ready to see what you might qualify for?

Compare current mortgage rates from multiple lenders without affecting your credit score.

Types of Mortgages: Finding the Right Fit

The mortgage market offers various loan types designed to meet different financial situations and homebuying needs. Understanding the differences can help you choose the option that best aligns with your long-term goals.

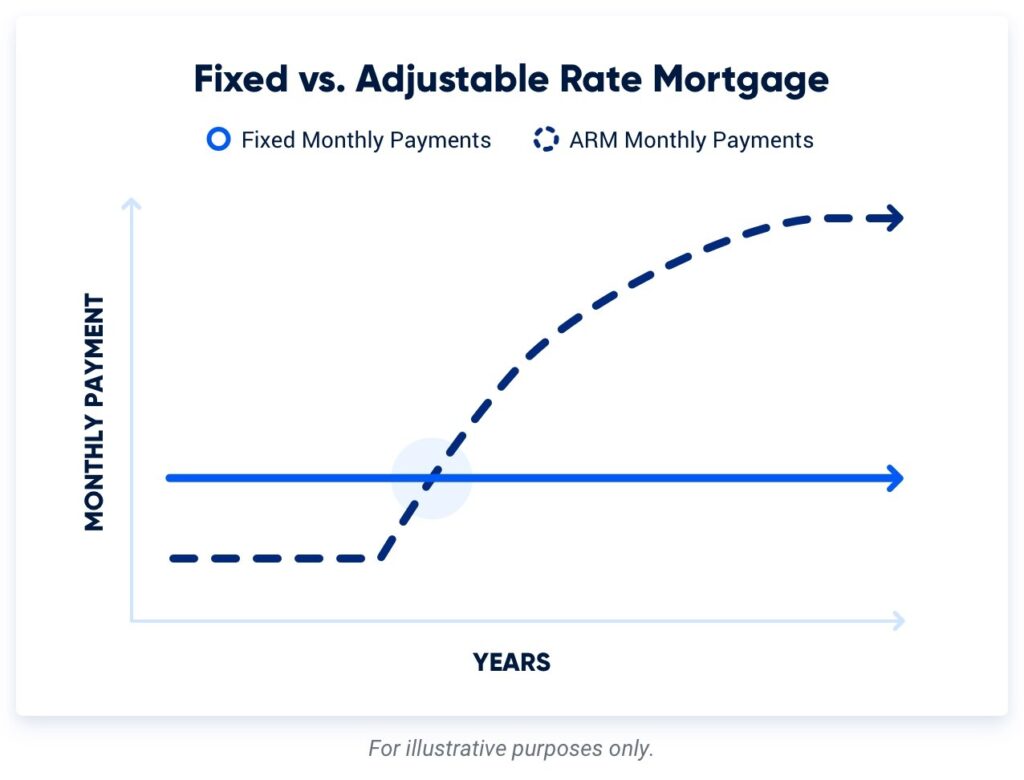

Fixed-Rate vs. Adjustable-Rate Mortgages

Fixed-Rate Mortgages

- Interest rate remains constant for the entire loan term

- Monthly principal and interest payments never change

- Easier to budget for the long term

- Protection from rising interest rates

- Most common terms are 15 and 30 years

Adjustable-Rate Mortgages (ARMs)

- Interest rate changes periodically after initial fixed period

- Usually starts with lower rates than fixed-rate mortgages

- Monthly payments can increase significantly over time

- More complex to understand with caps and adjustment periods

- Common types include 5/1, 7/1, and 10/1 ARMs

A 30-year fixed-rate mortgage is the most popular choice for first-time homebuyers because it offers the lowest monthly payment. However, you’ll pay more interest over the life of the loan compared to shorter terms. A 15-year fixed-rate mortgage means higher monthly payments but substantial interest savings and faster equity building.

Government-Backed Loan Programs

FHA Loans

Insured by the Federal Housing Administration, these loans feature down payments as low as 3.5% and more flexible credit requirements (minimum score of 580).

Down payment: 3.5%+

VA Loans

Available to eligible veterans, active service members, and some military spouses, VA loans offer no down payment requirement and competitive interest rates.

Down payment: 0%

USDA Loans

Designed for rural and some suburban homebuyers with moderate to low incomes, these loans require no down payment but have geographic restrictions.

Down payment: 0%

Conventional Loans

Conventional loans are not backed by the government and follow guidelines set by Fannie Mae and Freddie Mac. They typically require higher credit scores (usually 620+) but can offer competitive terms:

- Down payments as low as 3% for first-time homebuyers

- No upfront mortgage insurance premium (unlike FHA loans)

- Private mortgage insurance (PMI) can be canceled once you reach 20% equity

- Conforming loans follow set loan limits ($726,200 in most areas for 2023)

- Jumbo loans exceed these limits and have stricter qualification requirements

Essential Mortgage Terminology Explained

Understanding mortgage jargon is crucial when navigating the homebuying process. Here’s a breakdown of key terms you’ll encounter:

APR (Annual Percentage Rate)

The yearly cost of a mortgage including interest and certain fees, expressed as a percentage. APR is always higher than the interest rate and provides a more complete picture of loan costs.

PMI (Private Mortgage Insurance)

Insurance required on conventional loans when the down payment is less than 20%. It protects the lender if you default but can be removed once you build sufficient equity.

Escrow Account

An account managed by your lender to pay property taxes and homeowners insurance. A portion of your monthly mortgage payment goes into this account.

Loan-to-Value Ratio (LTV)

The percentage of the home’s appraised value that you’re borrowing. A lower LTV (meaning a larger down payment) typically results in better loan terms.

Debt-to-Income Ratio (DTI)

The percentage of your gross monthly income that goes toward paying debts. Lenders typically prefer a DTI of 43% or less, including your new mortgage payment.

Closing Costs

Fees and expenses paid at the closing of a real estate transaction, typically 2-5% of the loan amount. These may include origination fees, appraisal fees, title insurance, and more.

Understanding Points and Credits

Discount Points

Optional fees paid to the lender at closing to reduce your interest rate. One point equals 1% of your loan amount. Buying points makes sense if you plan to stay in the home long enough to recoup the upfront cost through lower monthly payments.

Lender Credits

The opposite of discount points – the lender covers some of your closing costs in exchange for a higher interest rate. This reduces your upfront costs but increases your monthly payment and total interest paid over the life of the loan.

Calculate your potential mortgage payment

Use our mortgage calculator to estimate your monthly payments based on loan amount, interest rate, and term.

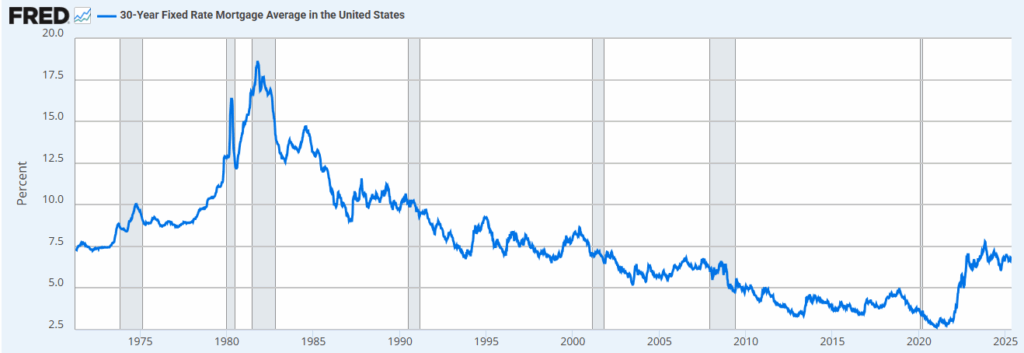

How Mortgage Interest Rates Work

Mortgage interest rates significantly impact your monthly payment and the total cost of your loan. Even a small difference in rate can translate to thousands of dollars over the life of your mortgage.

Factors That Influence Your Mortgage Rate

Credit Score

Higher scores (740+) qualify for the best rates. Even a 20-point improvement in your score could lower your rate.

Down Payment

Larger down payments (20%+) typically secure better interest rates by reducing the lender’s risk.

Loan Term

Shorter-term loans (like 15-year) generally have lower interest rates than longer-term loans (30-year).

Loan Type

Conventional, FHA, VA, and USDA loans each have different rate structures based on their risk profiles.

Property Type

Single-family homes typically receive better rates than condos, multi-family, or investment properties.

Market Conditions

Broader economic factors, Federal Reserve policies, and inflation all influence the general direction of mortgage rates.

Rate Locks: Securing Your Interest Rate

Once you’ve found a favorable rate, you can request a rate lock from your lender. This guarantees your interest rate won’t change for a specific period (typically 30, 45, or 60 days) while your loan is being processed. Some considerations:

- Longer lock periods may cost more or come with slightly higher rates

- If rates fall significantly after you lock, ask about “float down” options

- If your lock expires before closing, extension fees may apply

- Get the rate lock agreement in writing, including all terms and conditions

Tips for Securing the Best Mortgage Rates

- Improve your credit score – Pay down credit card balances, avoid new credit applications, and resolve any errors on your credit report at least 3-6 months before applying.

- Save for a larger down payment – Aim for at least 20% to avoid PMI and qualify for better rates. Even increasing from 5% to 10% can make a difference.

- Reduce your debt-to-income ratio – Pay down existing debts, especially high-interest credit cards, to improve your DTI ratio before applying for a mortgage.

- Shop multiple lenders – Compare offers from at least 3-5 different lenders, including banks, credit unions, and online lenders. All mortgage inquiries within a 14-45 day period count as a single credit inquiry.

- Consider different loan terms – If you can afford higher monthly payments, a 15-year mortgage typically offers lower interest rates than a 30-year term.

- Ask about relationship discounts – Some lenders offer rate discounts for existing customers or if you set up automatic payments from their checking accounts.

- Consider buying points – If you plan to stay in your home for many years, paying points upfront to lower your interest rate could save money long-term.

Pro Tip: The best time to shop for a mortgage is when you’re financially prepared but before you start house hunting. Getting pre-approved gives you a clear budget and strengthens your position when making offers.

Ready to start your mortgage journey?

Get pre-approved and know exactly how much home you can afford.

The Mortgage Application Process: Step by Step

Understanding the mortgage application process helps you prepare properly and avoid surprises along the way.

Before You Apply: Get Your Finances in Order

Check Your Credit Reports

Review your credit reports from all three major bureaus (Equifax, Experian, and TransUnion) for errors or issues that need addressing. You’re entitled to one free report from each bureau annually through AnnualCreditReport.com.

Gather Financial Documents

Lenders will require extensive documentation. Prepare by gathering recent pay stubs, W-2s, tax returns for the past two years, bank statements, investment account statements, and documentation of other assets and debts.

Mortgage Application Checklist

- Get pre-approved – Submit basic financial information to a lender to receive a pre-approval letter stating how much you might qualify to borrow. This strengthens your position when making offers.

- Find a home and make an offer – Once your offer is accepted, you’ll move forward with the full mortgage application.

- Complete the formal application – Fill out the Uniform Residential Loan Application (Form 1003), providing detailed information about your finances, employment history, and the property.

- Submit documentation – Provide all required financial documents to your lender for verification.

- Home appraisal and inspection – The lender will order an appraisal to verify the home’s value. Separately, you should arrange a home inspection to identify any issues with the property.

- Underwriting – The lender’s underwriting team reviews your application, credit, income, assets, and the property details to make a final decision on your loan.

- Receive loan commitment – If approved, you’ll receive a commitment letter outlining the terms of your mortgage.

- Closing disclosure review – At least three business days before closing, you’ll receive a Closing Disclosure detailing your final loan terms and closing costs.

- Closing – Sign the final paperwork, pay closing costs, and receive the keys to your new home.

Common Reasons for Mortgage Application Delays

- Incomplete documentation or missing information

- Changes in employment or income during the application process

- New debts or credit inquiries after pre-approval

- Appraisal coming in lower than the purchase price

- Issues discovered during the home inspection

- Title problems or liens on the property

Important: Avoid making major financial changes during the mortgage process. Don’t open new credit accounts, make large purchases, or change jobs if possible, as these can delay or derail your approval.

Understanding Mortgage Costs Beyond the Principal and Interest

Your monthly mortgage payment typically consists of more than just principal and interest. Understanding the full cost helps you budget accurately for homeownership.

The Components of a Mortgage Payment (PITI)

Principal

The portion of your payment that reduces the original loan amount. This builds equity in your home.

Interest

The cost of borrowing money, calculated as a percentage of your remaining loan balance.

Taxes

Property taxes assessed by local government, often collected monthly and held in escrow until due.

Insurance

Homeowners insurance and, if applicable, private mortgage insurance (PMI) or government-backed loan insurance.

Closing Costs Explained

Closing costs typically range from 2% to 5% of the loan amount and may include:

- Loan origination fee (0.5-1% of loan amount)

- Appraisal fee ($300-$500)

- Credit report fee ($25-$50)

- Title search and insurance ($500-$1,000)

- Survey fee ($400-$600)

- Home inspection ($300-$500)

- Attorney fees ($500-$1,000)

- Recording fees ($25-$250)

- Prepaid expenses (varies)

Negotiating Closing Costs: Some closing costs are negotiable, while others are fixed. You can ask the seller to contribute toward your closing costs (seller concessions) or negotiate with your lender on certain fees.

Mortgage Refinancing: When and Why to Consider It

Refinancing replaces your current mortgage with a new one, potentially with better terms. Understanding when refinancing makes sense can save you thousands over the life of your loan.

Common Reasons to Refinance

Lower Your Interest Rate

If market rates have dropped significantly since you obtained your mortgage, refinancing could reduce your monthly payment and total interest paid.

Shorten Your Loan Term

Switching from a 30-year to a 15-year mortgage can help you pay off your home faster and save substantially on interest, though monthly payments will be higher.

Convert Between Fixed and Adjustable Rates

Switch from an ARM to a fixed-rate mortgage for stability, or from fixed to ARM if rates have dropped and you plan to move soon.

Tap Into Home Equity

Cash-out refinancing allows you to borrow against your home’s equity for major expenses like home improvements, education, or debt consolidation.

Remove PMI

If your home has appreciated and you now have 20% equity, refinancing can eliminate private mortgage insurance payments.

Consolidate Debts

Replace high-interest debts with a lower-interest mortgage, potentially saving money and simplifying your finances.

When Refinancing Makes Financial Sense

Consider these factors when evaluating whether refinancing is worth it:

- Break-even point: Calculate how long it will take for your monthly savings to offset the closing costs of refinancing.

- How long you’ll stay in the home: Refinancing typically makes sense if you plan to stay in your home beyond the break-even point.

- Current equity: Having at least 20% equity often qualifies you for better refinancing terms.

- Credit score improvements: If your credit has improved significantly since your original mortgage, you might qualify for better rates.

- Rate difference: The traditional rule of thumb is that refinancing is worth considering if you can reduce your interest rate by at least 0.5-1 percentage point.

See if refinancing could save you money

Use our refinance calculator to compare your current mortgage with potential refinance options.

Special Considerations for First-Time Homebuyers

First-time homebuyers have access to special programs, grants, and educational resources designed to make homeownership more accessible.

Down Payment Assistance Programs

Many first-time buyers struggle with saving enough for a down payment. These programs can help:

- FHA loans: Require as little as 3.5% down with a credit score of 580+

- Conventional 97 loans: Offer 3% down payment options for qualified buyers

- State and local grants: Many states, counties, and cities offer down payment assistance grants that don’t need to be repaid

- Forgivable loans: Second mortgages that are forgiven if you stay in the home for a certain period

- Matched savings programs: Some programs match your savings for a down payment

Tax Benefits for First-Time Homebuyers

Homeownership comes with several potential tax advantages:

- Mortgage interest deduction on loans up to $750,000

- Property tax deduction (subject to SALT limits)

- Mortgage points deduction

- Home office deduction if you work from home

- Capital gains exclusion when you eventually sell

Note: Tax benefits depend on your specific financial situation. Consult with a tax professional to understand how homeownership will affect your taxes.

Common Mistakes to Avoid

- Not checking your credit before applying: Review your credit reports and scores at least 6 months before applying to address any issues.

- Skipping pre-approval: Get pre-approved before house hunting to understand your budget and strengthen your offers.

- Focusing only on the monthly payment: Consider the total cost of homeownership, including maintenance, utilities, and potential HOA fees.

- Making large purchases before closing: Avoid buying furniture, appliances, or cars on credit before closing, as this can affect your debt-to-income ratio.

- Not budgeting for closing costs: Be prepared for closing costs of 2-5% of the loan amount in addition to your down payment.

Frequently Asked Questions About Mortgages

How does my credit score affect my mortgage rate?

Your credit score is one of the most significant factors affecting your mortgage interest rate. Generally, scores of 740 or higher qualify for the best rates. Each 20-point drop below that typically results in a slight rate increase. Borrowers with scores below 620 may have difficulty qualifying for conventional loans and might need to consider FHA loans, which have more flexible credit requirements but typically come with higher costs.

How much of a down payment do I need?

Down payment requirements vary by loan type:

- Conventional loans: Typically 3-5% for first-time buyers, 5-10% for others

- FHA loans: As low as 3.5% with a credit score of 580+

- VA loans: 0% down for eligible veterans and service members

- USDA loans: 0% down for eligible rural properties

While lower down payments make homeownership more accessible, putting down 20% or more helps you avoid mortgage insurance and qualify for better interest rates.

What’s the difference between pre-qualification and pre-approval?

Pre-qualification is an informal process where a lender provides an estimate of how much you might be able to borrow based on self-reported information about your income, assets, and debts. It’s quick but carries less weight with sellers.

Pre-approval is more rigorous and involves a formal application, credit check, and verification of your financial information. You’ll receive a pre-approval letter specifying how much you’re approved to borrow. This carries more weight with sellers and gives you a clearer picture of your budget.

How long does the mortgage process take?

The typical mortgage process takes 30-45 days from application to closing, though it can vary based on:

- Loan type (conventional loans often process faster than government-backed loans)

- Your financial situation (self-employed borrowers may face more documentation requirements)

- Property issues (appraisal or inspection concerns can cause delays)

- Lender workload (busy periods can extend processing times)

To help the process move smoothly, respond promptly to requests for documentation and avoid making major financial changes during the application period.

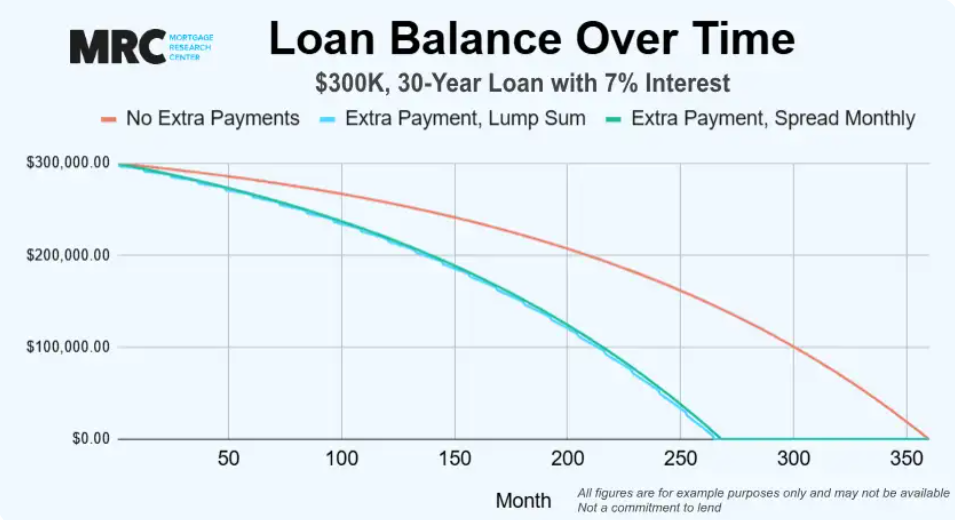

Can I pay off my mortgage early?

Yes, most mortgages allow for early payoff, though some may have prepayment penalties, especially in the first few years. Strategies for paying off your mortgage early include:

- Making biweekly payments instead of monthly (results in one extra payment per year)

- Rounding up your monthly payment

- Making one extra payment each year

- Applying windfalls (tax refunds, bonuses) to the principal

- Refinancing to a shorter term

Before making extra payments, check if your mortgage has prepayment penalties and consider whether the money might be better used for other financial goals, such as retirement savings or higher-interest debt.

Ready to take the next step?

Download our comprehensive mortgage application checklist to ensure you have everything you need for a smooth process.

Making Your Mortgage Decision

Navigating the mortgage landscape requires understanding various loan options, terminology, and processes. By taking the time to educate yourself, improve your financial position, and shop carefully among lenders, you can secure a mortgage that aligns with your long-term financial goals.

Remember that a mortgage is likely the largest financial commitment you’ll make in your lifetime. While the process may seem complex, breaking it down into manageable steps makes it more approachable. Focus on finding the right balance between affordable monthly payments and favorable long-term costs.

Whether you’re a first-time homebuyer or looking to refinance, the effort you put into researching and preparing for your mortgage will pay dividends in the form of better terms, lower costs, and greater peace of mind as you embark on your homeownership journey.

Start your homebuying journey today

Compare personalized mortgage offers from multiple lenders to find your best rate.